What Trends Are We Seeing?

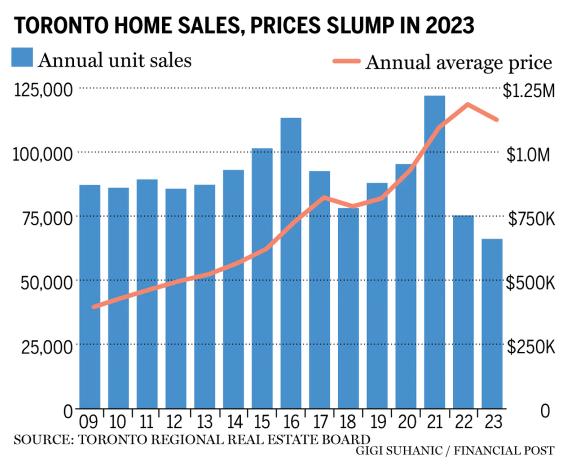

Interest rates have had a noticeable impact on year-over-year activity across Canada. Throughout 2023 increasing interest rates initially sidelined Buyers and subsequently sidelined Sellers. The result has been a 12 percent decrease in transactions in 2023 compared to 2022 on the Toronto Regional Real Estate Board (TRREB). Average prices also decreased, with a 5.4 percent drop in 2023 compared to 2022. Given the drastic interest rate changes we have seen in the past year, a price decrease of only 5.4 percent is demonstrative of the resilience of the Toronto and Greater Toronto Area (GTA) Housing Market.

From a month-over-month perspective we see a market poised for growth. December 2023 yielded 11.5 percent greater transactions than December 2022 and an average price that was 3.2 percent higher. December 2023 sales rose in all categories across the GTA except for condo apartments.

Leading the way were semi-detached sales with a 36.7 percent increase in sales for the month. The increased number of transactions coincided with a 6.6 percent reduction in new listings in December 2023 compared to that of December 2022; indicating buyers were willing to enter transactions despite a reduced number of new options compared to the previous year.

In December we noticed the return of multiple offers on properties, and buyers willing to make purchases over the Holiday Season. We experienced as many as 23 registered offers on a home, listings posted after Christmas and sold before New Year’s, and continued showing activity in the Real Estate market.

What Lies Ahead?

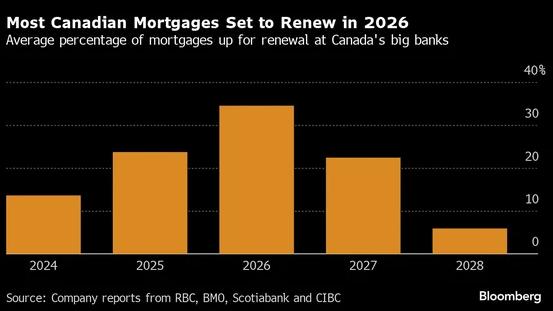

Anticipation is the theme of the current market. We are closely watching unemployment numbers, Gross Domestic Product, interest rate announcements, inflation impacts, buyer behaviours, mortgage delinquencies, and seller propensity to sell. Many mortgage holders are facing renewals at substantially different rates over the next three years; 14 percent of mortgage holders in 2024 will face renewal, 24 percent in 2025, and 35 percent in 2026.

The duress sale is not expected to resolve the affordability challenges faced by the Toronto and GTA housing market. Many predict that borrowers are well positioned to handle the increased carrying cost of renewed mortgages, interest rates will be lower, and increasing population count will increase demand.

It is widely expected that interest rates will hold at the January 24th rate announcement and begin to decrease during the second quarter. Expectations are that an interest rate balance will be one that allows economic growth without putting pressure on inflation.

Unemployment is a key dynamic being watched in terms of the timing of an interest rate adjustment in 2024. The current unemployment rate at 5.8 percent is insufficient for the Bank of Canada to implement rate reductions, especially given that wage growth is at its strongest pace since January 2021 having accelerated to 5.7 percent for permanent employees. Ideally the Bank of Canada would like to see the unemployment rate between six to 6.5 percent to start implementing interest rate reductions.

An important factor that participants and observers of the Toronto and GTA housing market should bear in mind is the impact of the 2024 United States election. As Canada’s largest trading partner, the American impact on the Canadian economy will be an important consideration in 2024.

Human nature looks for certainty in what lies ahead before making decisions, therefore we will likely see a slight pause in market activity in the period leading up to and following the election. It has been our experience that the outcome of elections can have a moderate impact on the housing market in Toronto and the GTA.

Next Steps for Those Considering Making a Lifestyle Change or Building Wealth with Real Estate:

For buyers – the next 30 to 90 days may be the opportunity to find the right property without the pressure of a significant number of additional buyers coveting the same property.

For sellers – the next 30 to 90 days may be the opportunity to be one of the few properties on the market as buyers have started coming out to purchase with the expectation of interest rate drops before there is a flood of sellers to the market.

The decision for each buyer and seller will be a function of their objectives and the micro market for the product being purchased or sold; feel free to reach out to discuss what will be the right steps for you.