What Trends Are We Seeing?

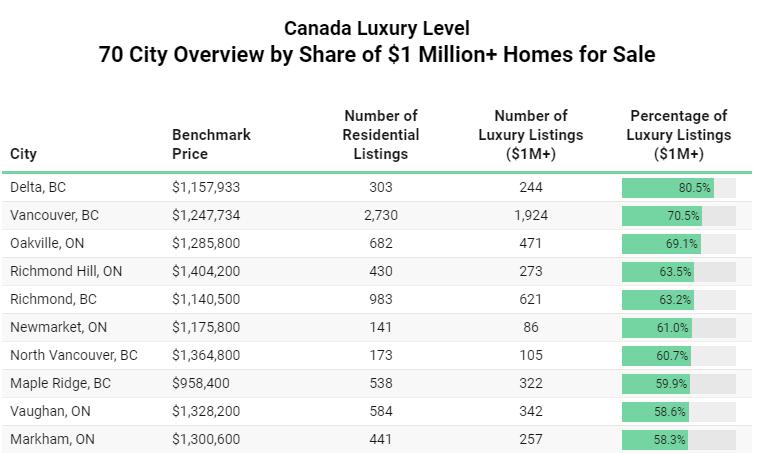

Some dizzying statistics about the cost of real estate in Canada, Toronto and the Greater Toronto Area (GTA) were delivered to us for February 2024. According to a Point 2 Homes report more than half the homes for sale in the GTA in February 2024 were priced above $1,000,000. The illustration below shows the breakdown of the Point 2 Homes study that reviewed 70 cities across Canada.

Richmond Hill was fourth on the list with 63.5 percent, Newmarket was sixth (61 percent) while Vaughan (58.6 percent), Markham (58.3 percent) Brampton (51.6 percent) and Whitby (50.3 percent).

Expanding the search up the price point continuum we find that properties above $4,000,000 in Oakville, Vaughan, Milton and Markham had between five and seven percent of its listings at or above that price point.

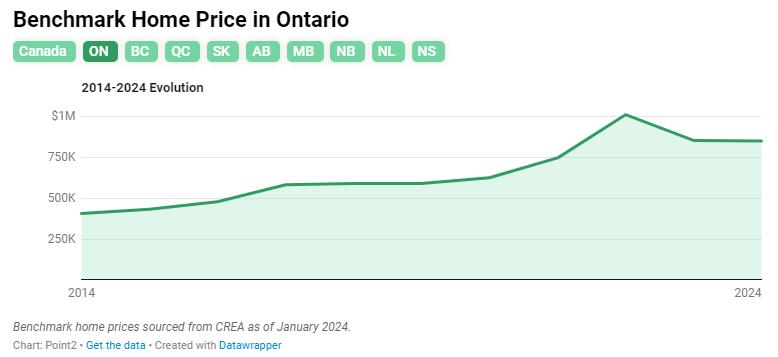

Stepping back and looking at things with a long-term perspective we see the cost of real estate over the last 10 years as a consistent escalation. While it has felt like a turbulent last 24 to 36 months, the Benchmark Home Price in Ontario shows stability for the most part.

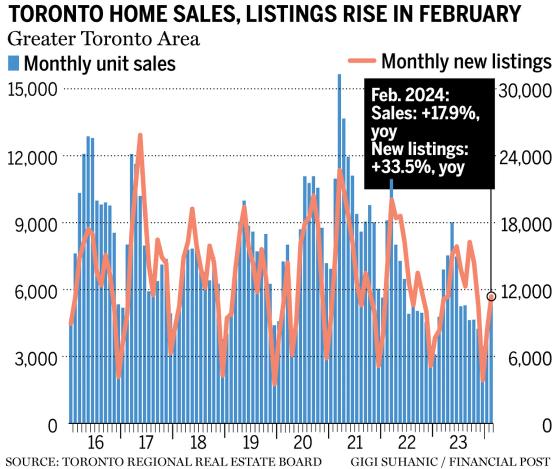

Focusing in on a more traditional analysis of market activity for February 2024 we noted that the number of sales year-over-year were up 17.9 percent and that the number of new listings increased by 33.5% year-over-year as illustrated below.

From an average price perspective when comparing February 2023 to February 2024 it remained essentially the same with a 0.44 percent increase.

What Lies Ahead?

What is happening on the ground in the day-to-day of our activities is that we are seeing consistent multiple offer situations develop depending on the area, product type and price point. Generally, products below $1,500,000 are generating increased activity, especially if it is turn-key products for buyers to purchase. Much of this activity has been spurred by the expectations of interest rate adjustments at some point throughout 2024.

Expectations for 2024 are most notably determined by the timing and magnitude of the interest rate adjustment. The CPI inflation eased to 2.9 percent in January as the goods price inflation moderated.

Notably, the cost of shelter remained elevated and is the biggest contributor to inflation. The Bank of Canada continues to have expectations that inflation will remain closer to 3.0 percent until mid-2024. Bank of Canada inflation expectations and corresponding interest rate decisions are driven by Gross Domestic Product (GDP) and employment figures.

Real GDP expanded in the fourth quarter of 2023 by a modest 1.0 percent after having contracted by 0.5 percent in the third quarter of 2023. Canada’s unemployment rate in February 2024 was 5.8 percent, very similar to the prior month. Notable however is that employment gains came primarily from the public sector which offset losses among Canadian businesses last month.

This shows that the labour market has been propped up by government hiring. Over the last year, employment in the public sector has grown 4.7 percent, versus 1.2 percent in private industry. Should we see moderate GDP growth or losses in conjunction with private sector employment demand drop; interest rate adjustments will shortly follow.

The Toronto and GTA real estate market has historically operated somewhat outside of expectations based on market indicators. The most recent evidence of this is that consumer confidence based on expected rate cuts has already impacted the pace of the real estate market. We expect that the market will continue to react to consumer confidence rather than documented rate changes.

What this means for buyers is that there may be at all price points and product types a more expensive entry-level than currently exists.

For sellers, with buyer anticipation and excitement, depending on the product type given that we have seen a notable increase in new listings already in 2024 it may be beneficial to present your property on the market sooner than later in terms of beating competing sellers to the market.