What Trends Are We Seeing?

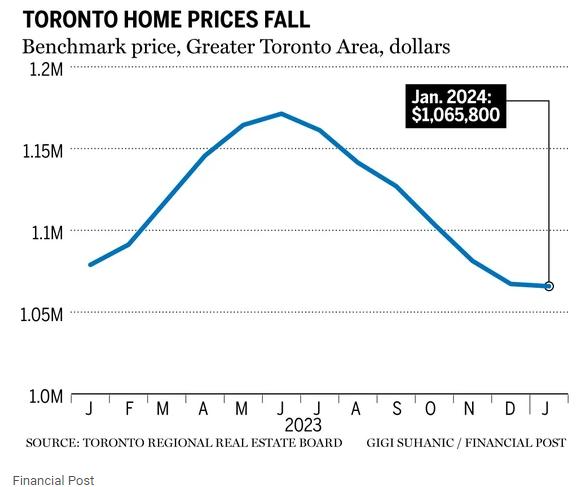

Here we go again! January 2023 saw an influx of activity when the Bank of Canada announced it would hold interest rates for the foreseeable future. The increased activity resulted in the Bank of Canada deciding to subsequently increase interest rates commencing a downward price trend that commenced in June 2023. A year later, with expectations of an interest rate drop in the second or third quarter of this year, we saw a 37 percent increase in January 2024 in the number of transactions compared to that of January 2023 with a nominal price decline of one percent.

What Lies Ahead?

The Bank of Canada is taking a definitive stance that interest rates alone will not be able to fix the housing market’s dilemmas of expected reduced affordability due to increased competition. With the housing market making up the largest single component of inflation at six percent, the Bank of Canada has noted it will take other measures to address the support needed for the 1.8 million newcomers to Canada in the last year and a half adding pressure from the demand side plus the Canadian Mortgage and Housing Corporation (CMHC) 3.5 million additional homes needed on top of expected growth for 2030 to reach affordability. We read this as a warning shot to Federal, Provincial and Municipal governments to act beyond observation of the Bank of Canada’s monetary policy.

While the Federal Government has announced an extension to the Foreign Buyers Ban, it is widely thought that this is accomplishing more politically than impacting the housing sector. It is estimated that, according to the latest data from Statistics Canada, non-resident ownership in a metropolitan like Toronto where foreign buyers flock to was only 2.6 percent. What may be missed in this particular policy is that a large share of foreign buyers purchases high-end properties and removing these buyers from the market results in tax losses and dampens the wealth creation for more affluent Canadians who benefit from the price gains at the higher end of the real estate spectrum.

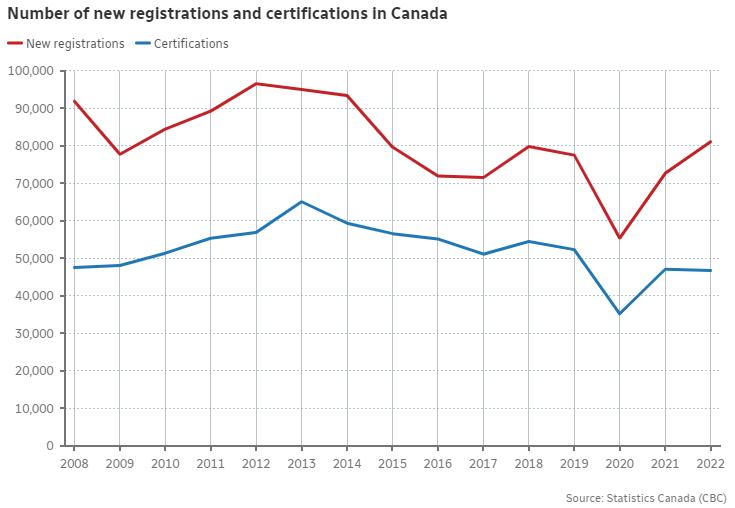

It is widely understood that contributing to the supply shortages is the lack of skilled trades. We have recently seen an increase in those enrolled in training providing a glimmer of hope that the levers may soon be in place to increase supply. The illustration below shows the number of new registrations in apprenticeship programs which include many of the skilled trades needed to build homes.

With the unemployment rate at 5.7 percent according to the February 9, 2024, figures by Statistics Canada, at the surface, things seem positive. However, the lower rate had more to do with the decline in participation rate than the increase in jobs. Coupled with a five percent wage growth it is exactly what the Bank of Canada needs to hold rates steady until later this year.

With expected interest rate decreases later this year, a lower supply of properties for buyers to consider, a continued increase of newcomers to Canada and consumer confidence that is likely exponentially unwarranted we expect price increases to be recognized. It is widely thought that 2024 will bring the second-highest average price that the Toronto Regional Real Estate Board has seen (February 2022 being the highest).