What Trends are we Seeing?

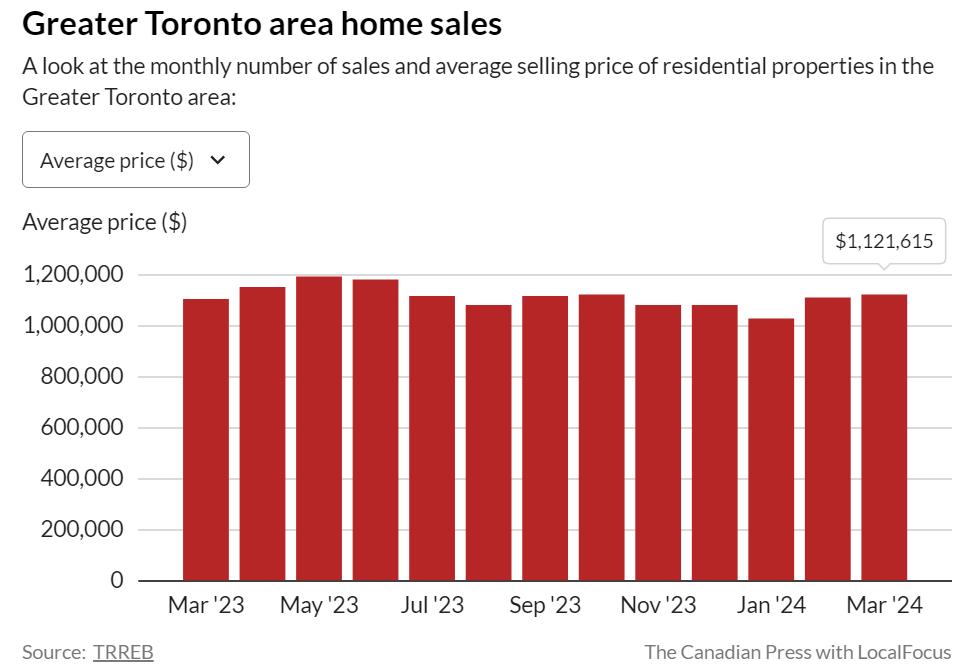

Despite a decreased number of transactions, buyers illustrated a willingness to pay more for what they wanted. The average price on the Toronto Regional Real Estate Board (TRREB) increased by 1.3 percent from March 2023 to March 2024 ($1,121,615). This was even though new listings had increased by 15.1 percent. Overall, the market remained balanced between buyer and seller with a 50 percent Sales to New Listing Ratio (SNLR); SNLR greater than 60 percent is a seller’s market and less than 40 percent is a buyer’s market.

Stepping back and looking at the first quarter of 2024 there were 11.2 percent more transactions with an additional 18.3 percent more new listings.

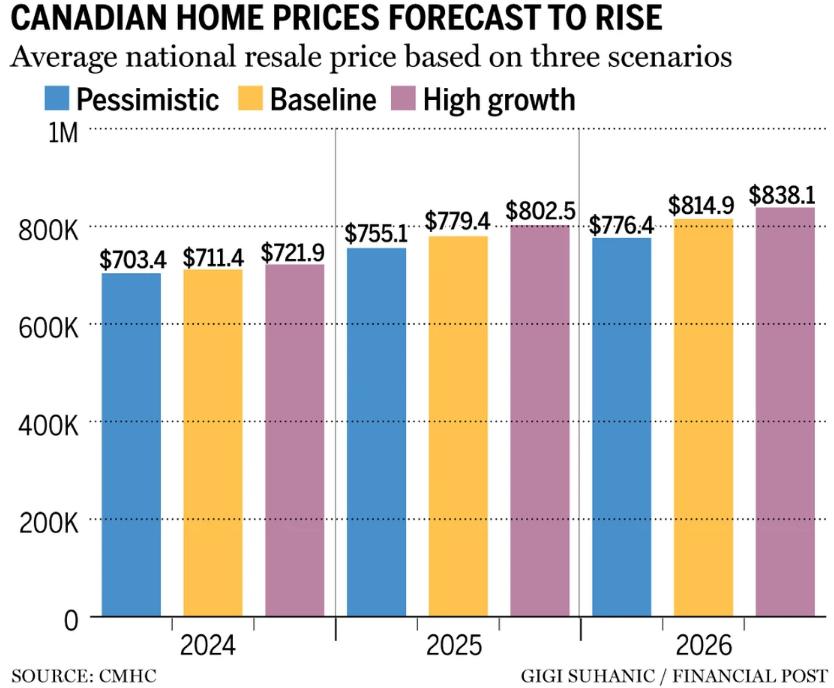

Price increases are expected to continue, as predicted by the Canadian Mortgage and Housing Corporation, as the expected reduction to interest rates takes hold in the back half of this year fueled by the 2023 strongest population growth Canada has ever seen (since the 1950s) creating additional demand. Below is an illustration of projected average price scenarios for 2024 through 2026.

From a luxury home perspective, we have seen a migration away from larger more traditional cities like Toronto and Vancouver as luxury buyers choose to get more impact for their dollar in non-traditional luxury communities in other parts of the Country. This does not mean that the Greater Toronto Area luxury market has been dormant, in fact, we have seen a 14 percent increase in transactions versus the same time last year.

This however lags compared to areas such as Calgary, Montreal and Saskatoon that have seen over 50 percent increase to their number of luxury transactions. Ontario saw 60,000 people migrate last year able to take their Ontario real estate wealth and convert it into luxury living elsewhere in Canada.

What Lies Ahead?

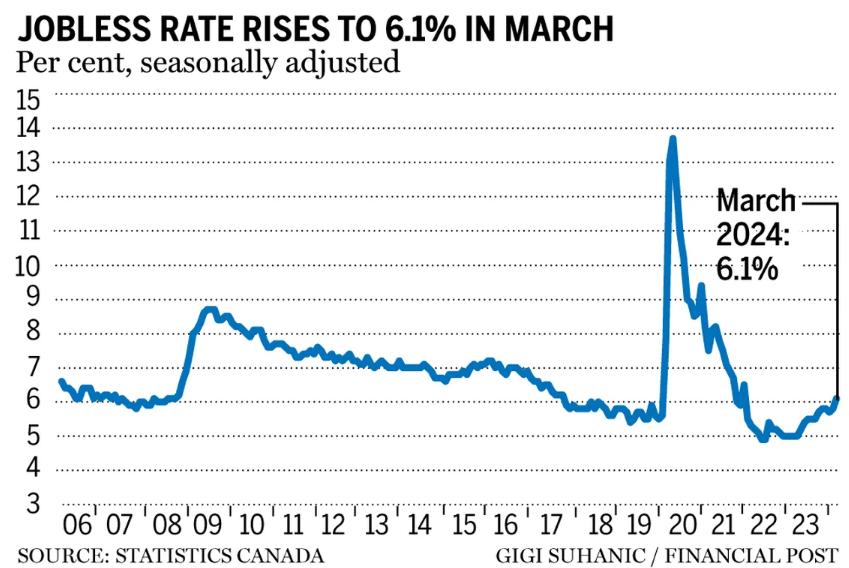

Long anticipated interest rates draw nearer. Traditionally unemployment rates just below 6.0 percent are idea for a strong economy. As we retract from quantitative easing it may be that the Bank of Canada will feel comfortable to lower interest rates when unemployment falls between 6.0 percent and 6.5 percent; most recent figures indicated 6.1 percent unemployment. This is the highest unemployment rate that Canada has seen in two years setting the stage for the Bank of Canada’s patience with respect to interest drops to dissipate. Outside of COVID19, 6.1 percent unemployment is the highest unemployment since 2017.

The country shed 2,200 jobs in March. This accompanied by the slower pace of hiring relative to population growth over the last few months provides comfort to the Bank of Canada that an interest rate reduction won’t stoke the flames of inflation; the timing of said adjustment is the question.

This week Bank of Canada will announce its interest rate decision on what to do with its two-decade-high 5 percent policy rate. It is highly anticipated that interest rates will remain the same with only a 20 percent probability of a cut this week factored into most financial market odds.

With the past two inflation reports having a Consumer Price Index of slightly under 3 percent for January and February we are approaching the Bank of Canada target of 2 percent. Interestingly, the largest driver of inflation at this time is mortgage interest costs.

It is a tangled web as the tool to combat inflation also exacerbates the mismatch between housing affordability, supply and population growth creating demand. Financial markets have odds at 60 percent that the Bank of Canada will make an interest rate adjustment in June 2024.

What this means for sellers is that their resilience to bend to buyer demands for lower prices may soon pay off as prices begin to crescendo to a 2026 high.

For buyers, the opportunity buys have potentially passed as new buyers enter the market with lower interest rates opening the gates and increasing purchasing power. The fundamental question of whether it will be more expensive to purchase today versus tomorrow will be yielding the unrelenting answer it has for so many years prior…