What Trends are we Seeing?

It feels like Groundhog Day in December. The market statistics for November 2023 tell a similar story when we examine the year-over-year figures as we have seen for several months now; number of sales is down, the buyers’ market is in place and yet prices are not changing dramatically. Number of transactions on the Toronto Regional Real Estate Board (TRREB) were down six percent from November 2022 (4,507) compared to November 2023 (4,236). Despite the number of new listings in November 2023 being 16.5 percent higher than that of November 2022; the average price in November 2023 remained essentially flatlined with a 0.3% increase compared to November 2022. The month-over-month average selling price was down 2.2 percent from October 2023 to November 2023. Average sale price by market segment breakdown shows a varying degree of adjustment when comparing both year over year and month over month. None of the percentage adjustments exceed 6.4 percent; illustrating segment stability as well.

What Lies Ahead?

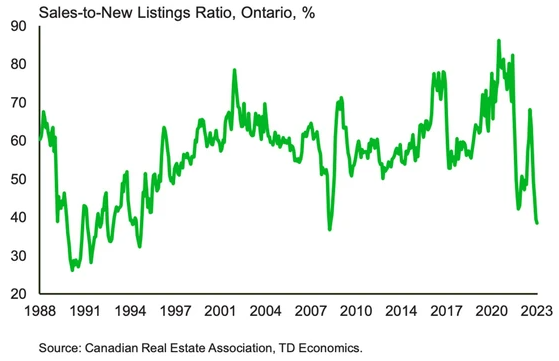

There has been substantial discussion about the “housing crisis” and what lies ahead with a significant number of mortgages commencing to renew in 2024 through to 2026. As the Sales-to-New Listings Ratio (SNLR) has been in buyer market territory for consecutive months, we examine the ratio over time below for perspective.

Ontario’s Housing Market Sales-to-New Listings Ratio

While we note that the SNLR is falling within the same territory that has been seen during past downturns in the housing market, it is notable that consumer behaviour shows a priority to meet mortgage obligations. With interest rates seemingly having hit their 22-year high of five percent and an expectation that interest rates will decrease next year, mortgagees are holding on.

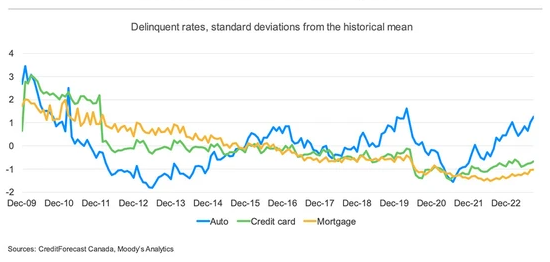

Delinquency Payments for Auto, Credit Card and Mortgage

Delinquencies of mortgage payments are below their historical averages and the number of overdue payments is only a third of what they were after the financial crisis (2008).

Consumer confidence will likely be on the rise at a more aggressive than expected rate as we enter 2024 for buyers. Many economists have predicted between a 100 to 300 basis point decline in interest rates next year with some indicating the drops could start as early as April 2024. From a buyer’s perspective if we take the mindset that you marry the purchase price and date the interest rate, now is the time to come off the sidelines. From seller’s perspective, price stability is in place and potentially on the rise so depending on your circumstances a more immediate sale may make sense prior to a flood of listings to the market or a pause until we see buyers come back in full swing could be beneficial.