What Trends Are We Seeing?

The price of real estate in the Toronto and Greater Toronto Area (GTA) has taken on the notable

characteristic of “stubborn”. Even though the sales-to-new listing ratio (SNLR) was 32.3 per

cent and still technically defined as a “buyer’s market”, the average price of a home has risen by

3.5 per cent from October 2022 to October 2023. The cost of detached, semi-detached and

townhouses have all seen price increases in Toronto and the GTA from October 2022, going up

by 6.1 percent to $1,450,122 (detached), 2.1 percent to $1,102,721 (semi-detached) and 1.1 per

cent to $930,185 (townhouses) respectively. The only segment which realized a price decrease

was the condo segment with a 1.2 per cent decrease to $708,780. Not only is the average price

higher from October 2022, but it is also the second straight month where we have seen the

month-over-month average price increase with a 0.6 per cent increase to $1,125,928.

Despite home number of transactions being down on the Toronto Regional Real Estate Board

(TRREB) by 5.8 per cent year over year from 4,930 (October 2022) to 4,646 (October 2023)

sellers are taking the position that if they sell their homes it will be at the figures they are

comfortable with. Some buyers may be rationalizing the decision to proceed if they want to buy

on the basis that average prices are well-below their record peak reached early 2022, so lower

home prices have mitigated the impact of higher borrowing costs to some extent.

For those keeping track, it may be noted that the SNLR increased from September 2023s rate of

28.6 per cent to the 32.3 per cent in October 2023; meaning a movement toward a balanced

market. As a reminder, when we see a SNLR between 40 per cent and 60 per cent it is a

balanced market. A SNLR below 40 per cent is a buyers’ market and above 60 per cent is a

sellers’ market. The Toronto and GTA markets can shift swiftly so this is a ratio to watch over

the upcoming months as buyer confidence is impacted by stable interest rates (despite their

levels).

What Lies Ahead?

Much of the discussions regarding what lies ahead in the real estate market sits around

affordability, Gross Domestic Product (GDP), unemployment, immigration, interest rates and

ultimately inflation.

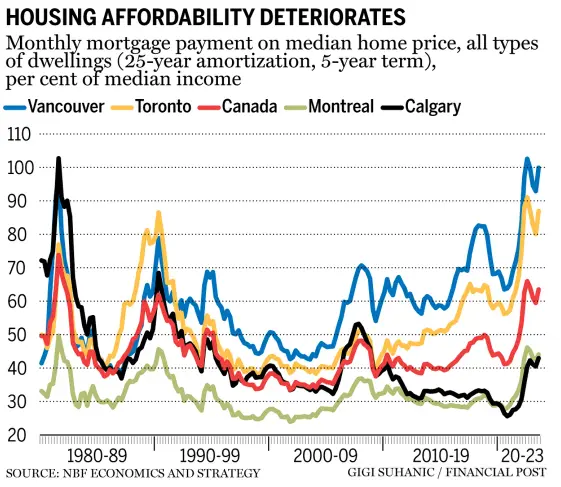

Affordability has never been more challenging throughout most of Canada. When reviewing the

major markets throughout Canada affordability is worsening as noted in the illustration below.

Ultimately the deterioration of affordability in the Canadian housing market is a function of

overriding supply shortages, population growth and mortgage rate increases. Affordability

stands near the wort it has been in a generation, only requiring an increase in average home

prices of two per cent in the fourth quarter to set a record. Although the Canadian government

announced a status quo for immigration targets going through to 2025, this does not change the

fact that we have seen a population increase by over one million between 2022 and July 2023

creating an overwhelming demand side imbalance throughout different market segments of

housing.

Should GDP hold at its current projections for the third quarter Canada will have technically

slipped into a subtle recession. We will have seen a contraction of 0.1 per cent in the third

quarter and 0.2 per cent in the second quarter. Even the semantics of a “modest” recession

should impact the Bank of Canada’s decision around interest rate increases.

When reviewing employment, which will in turn have an impact consumer confidence, we have

now seen four of the last six months find an increase to the jobless rate which now sits at 5.7 per

cent. Labour remand is cooling which coincides with Canadian businesses insolvencies having

risen 41.8 per cent from last year. The insolvencies from Canadian businesses are likely a

function of the withdrawal of COVID-19 support, higher interest rates and a slowed consumer

spending behaviour.

Accounting for the above noted factors, unless there is a surprising increase to the core

inflationary numbers, one would expect interest rates to be held and have hit their peak since

their commencement of escalation to reduce inflation. The next questions becomes, when will

interest rates begin to drop. Many economists are of the opinion that the drop in interest rates

will not commence until the Bank of Canada sees inflation much closer to two percent (2.3 to 2.5

per cent). It is likely that our current interest rate threshold is here to stay with reprieve for

borrowers being found at earliest mid/end 2024. Keep in mind that the Bank of Canada will have its own motivation to move interest rates down prior to 2025 and 2026 as that is when more

than 57 per cent of outstanding mortgage totals are due to reset. Should the mortgages reset at

current interest rate levels (a 22-year high of five per cent) it could create another shock to the

economy with housing market volatility.

If it feels like a lot to take in and many factors to account for, it is. As a buyer, understanding

that the market tends to shift aggressively upwards when buyer psychology changes one might

want to get ahead of the curve by purchasing late 2023 or early 2024. As a seller, it seems if you

are on the market now, despite a technical buyer’s market, prices continue to escalate, and a

potential shift of interest rates accompanied by buyer exuberance could be around the corner at

some point in 2024.